During the early days of the Internet, visionaries dreamed of charging for content. But once the advertising revenue dwindled, many content providers abandoned micropayments. Today, the problem is much more complex, and some of the most successful companies are in the developing world. But for the United States, it is unclear if micropayments will make a difference for the masses. Here are the reasons why you should consider micropayments:

One reason that micropayments are so popular is the fact that they are easy to use. People make micropayments to pay for various services and products, such as mobile prepaid, electricity bills, or book rentals. Because of the simplicity of the process, many people are using them to reduce their expenses while enjoying the convenience of paying only a small fee. Some even want to cash out their entire limit through one payment. While the possibilities are many, it is important to understand how micropayments work and how they can benefit the public.

Micropayments are very similar to loans. The principle is simple: if you buy something, you pay it back later. The amount you pay back is the reward you get for doing so. This makes micropayments a convenient way to make purchases. You can use micropayments for mobile prepaid, electricity bills, and other services. Then, you can add the reward amount to your next electricity bill. These micropayments are very helpful for the general public, as they provide a more affordable means of paying for everyday necessities.

Micropayments are becoming increasingly popular. More people are making micropayments as a way to save money, and they are more convenient than ever. In fact, some people use micropayments to pay for a product or service that they have purchased online. The amount paid varies, but most people make one or two micropayments to get a book or a movie delivered. Different methods of payment can be used to complete the process.

Micropayments are popular in the Philippines and are now available on the Internet. The idea behind these micropayments is to make them more convenient for the general public. Whether you are buying a book, a ticket, or a subscription, it will cost you pennies or cents. There are many applications for micropayments. You can use these applications for everything from your mobile phone to your electricity bill. The best thing about these services is that they’re free, and they help you stay on budget.

Micropayments are especially useful for buying digital products that you can download from the Web. The marginal cost of creating and distributing a digital product is low, so the company can offer it at a low price. As long as there’s enough volume, however, the benefits of micropayments are immense. Consumers can pay for anything from a newspaper article to a song to software that can be downloaded. And while micropayments may seem like they are a little bit of an inconvenience, the general public will benefit from these services.

Micropayments are similar to loans. They give you an amount to pay, and you can pay it back at a later time. There are many benefits of using micropayments, and the public will appreciate them. It’s possible to cash in mobile phone micropayments anytime, anywhere, and anywhere. This service is useful to the general public, and is free to use. It allows people to pay their electricity bills in a small increment.

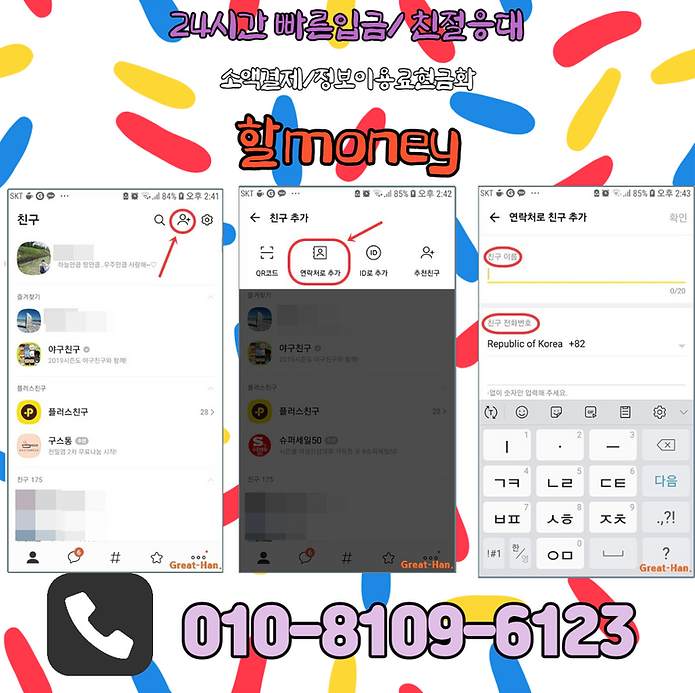

The use of 소액결제 현금화 is becoming more common in the United States. In the US, nearly every consumer has access to the Internet. It is easy to make purchases with a smart card, and payments are made electronically. With a smart card, you can store an entire bank account on a chip inside your card. That way, you can pay for anything without any financial intermediary. Ultimately, this technology is a boon for small-scale merchants, and is a great option for the future.

Micropayments are popular. Most of the time, a person will only need a small amount of cash to make their payments. There are no fees, and the service is easy to use. It’s also fast and convenient. The convenience of micropayments makes them a good choice for a number of situations. Moreover, they help the public by reducing their costs. When you need cash, micropayments can be a great solution.

Benefits of Converting Your Information Usage Fee Into Cash

Benefits of Converting Your Information Usage Fee Into Cash